Over the past few years, China saw more investment and installation in renewable energy than any other country in the world . In fact, in the period between 2010 and 2015, investment in the sector

reached $377 billion, more than the next two countries - the United States and Germany – combined.

China has 150 GW wind power and 77 GW solar photovoltaic power capacity compared to the U.S., for example,

which has 80 GW in wind and 35 GW solar PV.

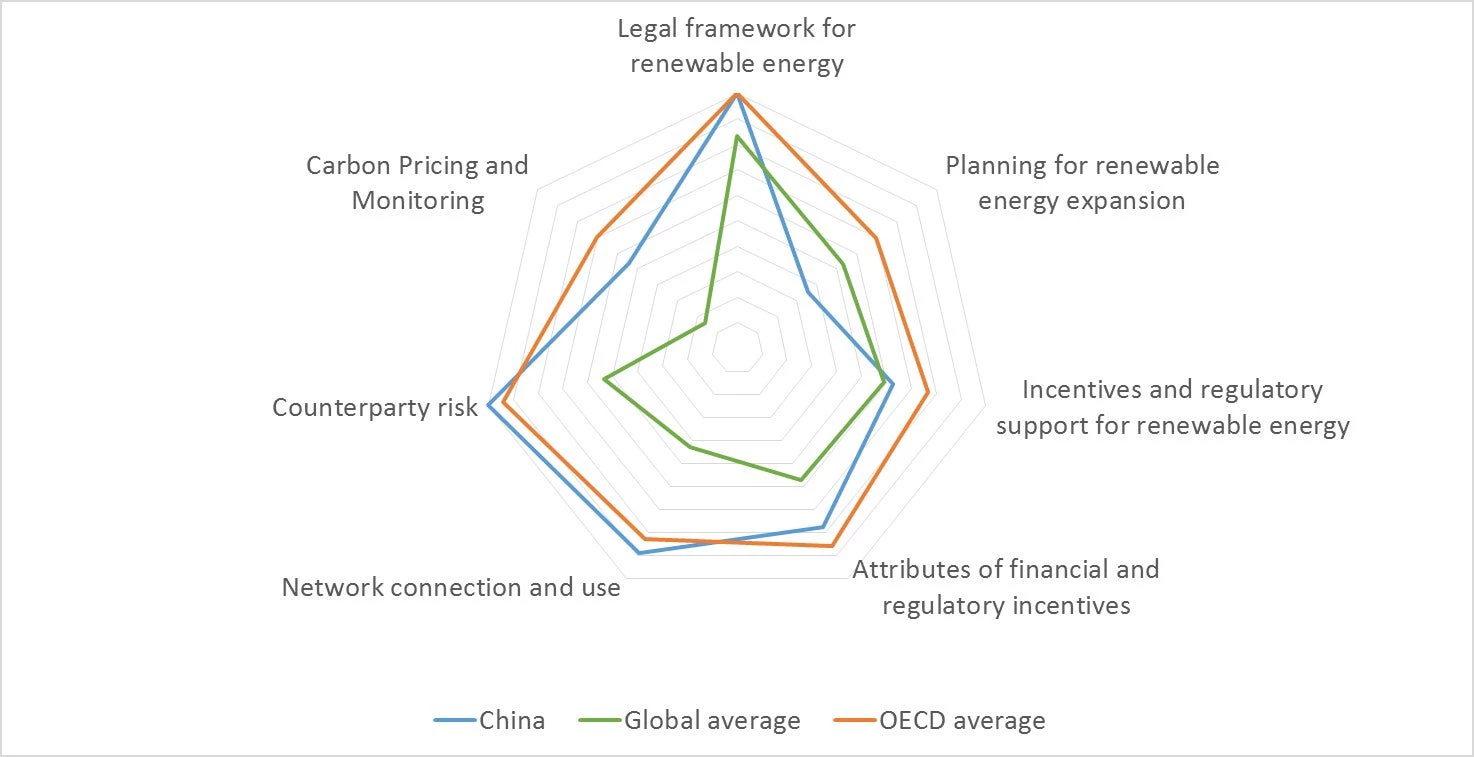

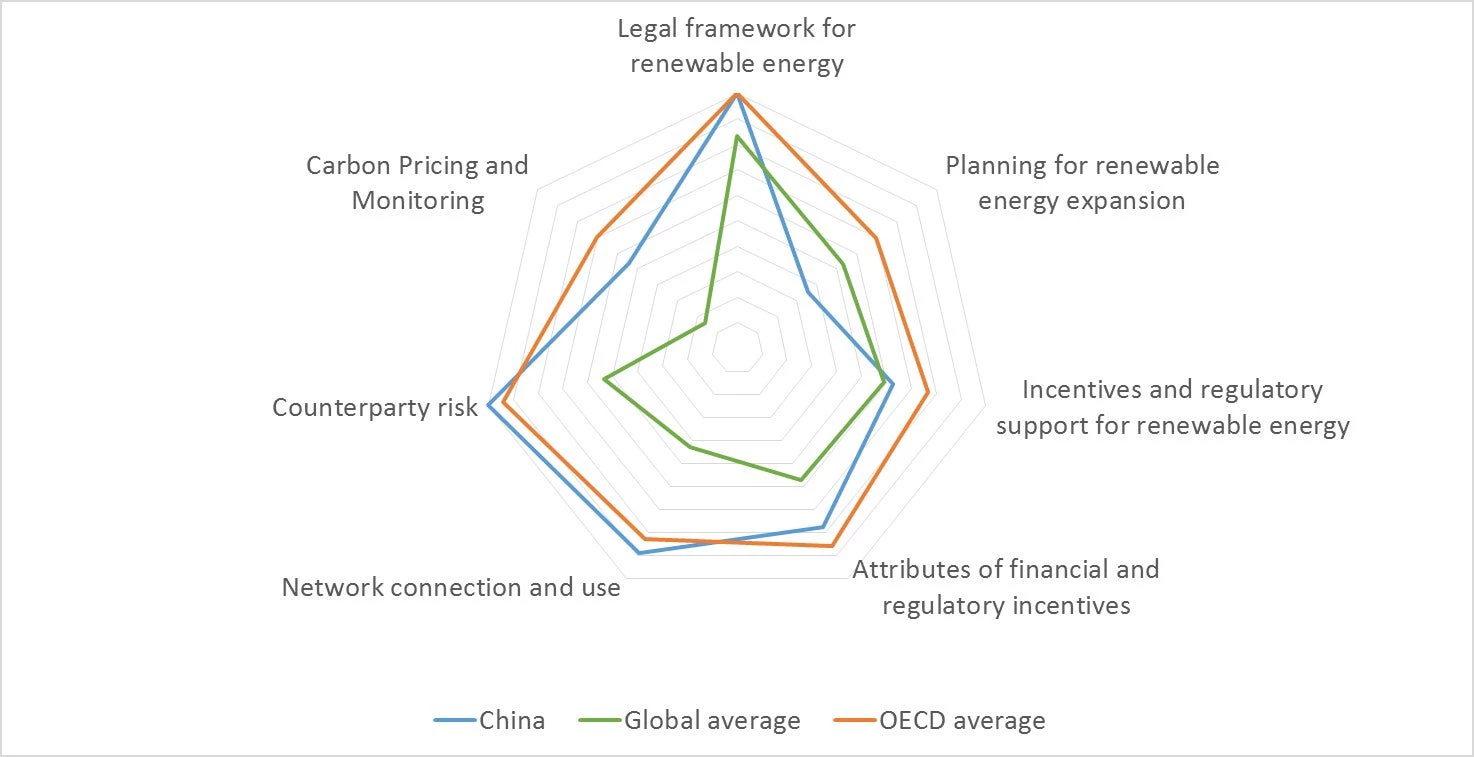

China has performed well above the global average, shined as the regional leader in East Asia, matched, if not outperformed, OCED countries in many dimensions, many countries with much lower investments and capacity have scored higher on renewable energy indicators.

Why the discrepancy?

The World Bank's Regulatory Indicators for Sustainable Energy (RISE) could shed some light on the issue. Launched in February 2017, RISE is a policy scorecard of unprecendented breadth and depth covering energy access, energy efficiency and renewable energy in 111 countries . It focuses on regulatory frameworks in these countries and measures that are within the direct responsibility of policy-makers. The result is based on data made available to the team at the end of 2015 and thoroughly validated.

RISE found that China’s conundrum is partly due to factors that are beyond what energy policy can control. China is the second largest economy in the world, with dramatically expanding power demand that creates opportunities of all kinds. A large and skilled labor force and supply chain allow cost-effective wind turbines or solar plants to be built locally. The government has also made important steps to mobilize private investment across all sectors.

However, some elements of the policy framework, if strengthened, might lead to even greater utilization of the country’s renewable resources. The average curtailment rate in 2016 is 17% which means 17% of generated electricity is not able to be delivered to final consumers, therefore wasted.

China could strengthen the following elements in its renewable energy regulatory framework:

1. An integrated planning structure in generation and transmission We found there is neither a power sector expansion plan nor a transmission plan that considers the scale-up of renewable energy. However the result didn’t take the new 13 th Five-Year Plan into consideration which has addressed systematically generation and transmission planning with renewable energy development. In addition, various planners in the energy sector (NDRC, NEA, MIIT, and MEP) still need to coordinate on where the most demand is. The key, as with other policies in China, is effective implementation and enforcement of planning at local levels.

2. Priority dispatch of generation from renewable sources While renewable energy plants enjoy prioritized access to the grid, generation is not dispatched based on operating cost, i.e. the economic dispatch order. China still has the dispatch rule of “equal shares generation,” which assigns all generating plants equal number of hours to operate each year, regardless of their actual operating cost. Furthermore, because utilities are not required to provide compensation for any form of curtailment, or where the required offtake infrastructure is not built in time, the risk falls entirely on the project developers. While this is not enough to limit all investment, it can lead to greater uncertainty and fewer financially viable projects.

3. Regional power exchange and grid integration Exchanging power between provincial areas is still limited due to the lack of an electricity market where power generation could be pooled together and exchanged among provinces. This is important because integrating a higher proportion of variable renewable energy causes power supply fluctuations. A larger balancing area helps enhance systematic stability. There are also administrative barriers and regional competition between provinces in China that block trading of power.

How can China bridge these gaps and get better at delivering clean electricity to end-users?

The country’s latest round of power sector reform aims to take on this very challenge. The overarching philosophy is to let market forces play a decisive role in the allocation of resources. As the GDP, as well as power demand, decelerates, it is critical to shift the mindset from installing more megawatts to actually delivering clean energy to consumers. To this end, these measures, if strengthened, could deliver more green power to Chinese consumers and achieve further carbon reduction:

If these measures are successfully implemented, China can easily accelerate its utilization of clean energy.

RISE was funded by the Energy Sector Management Assistance Program (ESMAP).

China has performed well above the global average, shined as the regional leader in East Asia, matched, if not outperformed, OCED countries in many dimensions, many countries with much lower investments and capacity have scored higher on renewable energy indicators.

Why the discrepancy?

The World Bank's Regulatory Indicators for Sustainable Energy (RISE) could shed some light on the issue. Launched in February 2017, RISE is a policy scorecard of unprecendented breadth and depth covering energy access, energy efficiency and renewable energy in 111 countries . It focuses on regulatory frameworks in these countries and measures that are within the direct responsibility of policy-makers. The result is based on data made available to the team at the end of 2015 and thoroughly validated.

RISE found that China’s conundrum is partly due to factors that are beyond what energy policy can control. China is the second largest economy in the world, with dramatically expanding power demand that creates opportunities of all kinds. A large and skilled labor force and supply chain allow cost-effective wind turbines or solar plants to be built locally. The government has also made important steps to mobilize private investment across all sectors.

However, some elements of the policy framework, if strengthened, might lead to even greater utilization of the country’s renewable resources. The average curtailment rate in 2016 is 17% which means 17% of generated electricity is not able to be delivered to final consumers, therefore wasted.

China could strengthen the following elements in its renewable energy regulatory framework:

1. An integrated planning structure in generation and transmission We found there is neither a power sector expansion plan nor a transmission plan that considers the scale-up of renewable energy. However the result didn’t take the new 13 th Five-Year Plan into consideration which has addressed systematically generation and transmission planning with renewable energy development. In addition, various planners in the energy sector (NDRC, NEA, MIIT, and MEP) still need to coordinate on where the most demand is. The key, as with other policies in China, is effective implementation and enforcement of planning at local levels.

2. Priority dispatch of generation from renewable sources While renewable energy plants enjoy prioritized access to the grid, generation is not dispatched based on operating cost, i.e. the economic dispatch order. China still has the dispatch rule of “equal shares generation,” which assigns all generating plants equal number of hours to operate each year, regardless of their actual operating cost. Furthermore, because utilities are not required to provide compensation for any form of curtailment, or where the required offtake infrastructure is not built in time, the risk falls entirely on the project developers. While this is not enough to limit all investment, it can lead to greater uncertainty and fewer financially viable projects.

3. Regional power exchange and grid integration Exchanging power between provincial areas is still limited due to the lack of an electricity market where power generation could be pooled together and exchanged among provinces. This is important because integrating a higher proportion of variable renewable energy causes power supply fluctuations. A larger balancing area helps enhance systematic stability. There are also administrative barriers and regional competition between provinces in China that block trading of power.

How can China bridge these gaps and get better at delivering clean electricity to end-users?

The country’s latest round of power sector reform aims to take on this very challenge. The overarching philosophy is to let market forces play a decisive role in the allocation of resources. As the GDP, as well as power demand, decelerates, it is critical to shift the mindset from installing more megawatts to actually delivering clean energy to consumers. To this end, these measures, if strengthened, could deliver more green power to Chinese consumers and achieve further carbon reduction:

- Open both wholesale and retail power market and adopt economic dispatch order. This is conducive to delivering more clean energy because it allows renewable power which usually has the lowest marginal generation cost, to be dispatched first.

- Strengthen regional balancing systems to increase the flexibility of grid management. A larger balancing area helps enhance systematic stability as intermittent renewable generation increases in the system.

- Setting feasible targets and timelines to reduce curtailment would be helpful to utilize more clean energy by end-users. This target should start in provinces with relatively lower curtailment rate. Reducing curtailment in Xinjiang province from 40% to 10% within 3 years is definitely more daunting than from 9% to 3% in Hebei province, for example.

- Decouple revenue of grid companies from sales volumes and allow them to charge a fixed cost from grid usage and maintenance. Grid companies’ revenues in China previously have been tied to the amount of electricity they sell. Decoupling will incentivize China’s powerful utility companies to move toward supporting clean, end-use energy efficiency and distributed renewables. The pilot project in Shenzhen is considered an exemplary model for China to move forward.

If these measures are successfully implemented, China can easily accelerate its utilization of clean energy.

Join the Conversation