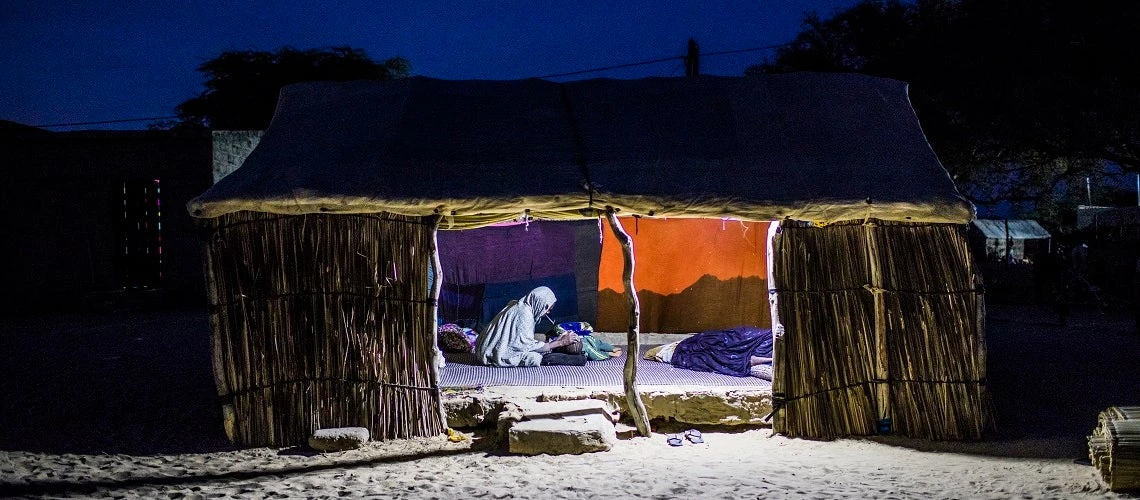

A woman puts to bed her baby at home, in Saint Louis, Senegal.

A woman puts to bed her baby at home, in Saint Louis, Senegal.

Like a Swiss Army Knife, Results-Based Climate Finance is a flexible tool to address a wide array of issues. Focusing on results creates incentives to take action -- from planting trees on degraded land or expanding access to clean energy, to enabling energy efficiency in industries. The promise of future payouts drives transformative change in many settings and among many stakeholder groups. The Carbon Initiative for Development (Ci-Dev) is making it easier for countries to access this versatile tool.

Rebuilding economies after the COVID-19 pandemic will put enormous strain on countries’ fiscal budgets and finance flows from development partners. Results-Based Climate Finance (RBCF) — payments made for achieving agreed-upon climate-related results, particularly reducing carbon emissions — can offer an important source of liquidity at this critical moment and support a resilient, equitable, low-carbon recovery.

"Results-Based Climate Finance — payments made for achieving agreed-upon climate-related results, particularly reducing carbon emissions — can offer an important source of liquidity at this critical moment and support a resilient, equitable, low-carbon recovery."

When Ci-Dev, backed by the World Bank, commits to results-based payments, the agreement often acts as collateral to catalyze vital private sector investment in climate projects. This approach appeals to project donors as they only pay for results achieved. It offers recipient countries another funding stream outside of already-pinched national budgets and traditional development assistance that prioritizes and scales up climate action. And it provides incentives to strengthen domestic institutions and infrastructure and spur local communities, private sector players, and other stakeholders to participate in and benefit from climate-smart activities.

But for all its utility, until recently RBCF has been a complicated tool to employ, putting off many would-be users. For some results-based climate mitigation projects, participants are working to achieve verified emissions reductions, which are converted into carbon credits for purchase. Payment only comes when emissions reduction targets are met, which can take years in some cases. Even with patience and projects structured with interim results, countries may not have the capacity to follow through with the complex carbon crediting processes. Demanding requirements for data monitoring, reporting, and verification (MRV) have burdened many low-income countries with high administrative and financial costs and slowed their entry into the carbon marketplace.

Standardized Crediting Framework (SCF)

To ease access to carbon credits and other Results-Based Climate Finance, Ci-Dev developed a Standardized Crediting Framework (SCF). The SCF builds on the World Bank’s successes and lessons learned implementing the Clean Development Mechanism (CDM), one of the main international systems for enabling conversion of emissions reductions into carbon credits under the Kyoto Protocol. It is a country-driven approach in which client countries and Ci-Dev work together to develop a crediting framework tailored to their circumstances. The SCF helps reduce time and expense incurred by countries by streamlining processes, aligning the crediting start date with the implementation date, eliminating the validation step, simplifying the project cycle, and standardizing the MRV system.

In a nutshell, the SCF allows program teams to focus more on delivering emission reductions and less on paperwork.

Lower costs, more capacity, quicker results

To put the SCF to the test, we first piloted it in Senegal within a rural electrification project. For over two years, it ran in parallel with the project’s CDM validation and registration, making it possible to compare the two processes, timelines, governance structure, stakeholder engagement, and transaction costs. The SCF achieved substantial cost savings and moved the project from development to its first emission reduction certification years faster than the CDM process.

We also took the SCF to Rwanda, where we used it to assess carbon credits generated by an efficient and clean cooking project over two years. The SCF cut implementation costs in half compared to the CDM, indicating significant efficiencies and return on investment. The pilot also demonstrated how the SCF puts the national government and institutions squarely in the driver’s seat.

The pilot allowed Rwanda to establish clear governance arrangements and technical materials for portions of the improved and clean cooking sector. This new level of transparency and predictability in decision making will make it easier for industry players to tap into carbon markets and RBCF, more generally.

By easing the technicalities and clarifying the governance around climate mitigation, the SCF has the potential to unlock the full power of RBCF. The framework is designed to be instrument neutral, so it can be used across a variety of activities under Article 6 of the Paris Agreement. In preparation for the new carbon marketplace that Article 6 will usher in, we are working on a broader rollout of the SCF. It also features prominently in a new World Bank Scaling Climate Action by Lowering Emissions (SCALE)* multi-donor fund taking shape as part of ongoing trust fund reforms. The facility aims to mainstream RBCF across World Bank operations so all our client countries can access this useful tool to achieve their development goals. Ensuring RBCF is within easy reach will help economies build back better post-pandemic and achieve a cleaner, greener future for all of us.

* previously the Climate Emissions Reductions Facility – CERF

instrument neutral, so it can be used across a variety of activities under Article 6 of the Paris Agreement. In preparation for the new carbon marketplace that Article 6 will usher in, we are working on a broader rollout of the SCF. It also features prominently in a new World Bank climate emissions reduction facility taking shape as part of ongoing trust fund reforms. The facility aims to mainstream RBCF across World Bank operations so all our client countries can access this useful tool to achieve their development goals. Ensuring RBCF is within easy reach will help economies build back better post-pandemic and achieve a cleaner, greener future for all of us.

Join the Conversation