Worker in a park in Bangkok

Worker in a park in Bangkok

Institutional investors increasingly wonder how their investments can make a positive impact and contribute to the Sustainable Development Goals (SDGs)—moving away from seeing environmental, social, and governance (ESG) factors simply as risks. This shift, initially led by large investors in Europe and other high-income markets, has become more and more global. Still, a challenge remains: how to implement ESG and impact investing tools in the context of less developed capital markets?

The duty of pension providers is no longer defined solely by maximizing investment returns and preserving the value of pension assets. Pension providers are increasingly seen as universal owners, having a wider responsibility to support sustainable global values.

One of the largest pension funds in Thailand, Government Pension Fund (GPF), was aware of this role when it announced, in 2018, its intention to be the leader in ESG investing and related initiatives in Thailand. Since then, GPF has pursued its mission through initiating and leading collaborative engagements with local institutional investors and with GPF’s external fund managers, both domestic and international ones. Throughout this time, it’s worked in close cooperation with the Organisation for Economic Co-operation and Development (OECD), the World Bank, and the United Nations Principles of Responsible Investing (UN PRI).

One of the central elements of the fund’s approach has been to integrate ESG factors into their research and decision-making processes. GPF does that via the GPF-ESG Weights and Scores: Asset Valuation Methodology, which analyzes and weighs ESG factors at the sectoral and at the company or issuer level, and then incorporates these results into asset valuation and pricing. The methodology comprises three main processes: pre-assessment process, ESG weight calculation process, and ESG score calculation processes. The second and the third processes use MSCI ESG data as raw data, but these are then adjusted to account for GPF’s own ESG beliefs, domestic information, and internal analysis, thereby customizing MSCI ESG data to be less global and more local.

Global tools with a local flavor

Initially, when using the MSCI data, GPF identified two issues: First, the data were calculated on a global basis, therefore not directly comparable with the reality in Thailand—with lower ESG standards and practices than the global average. Secondly, governance factors were a bigger concern for GPF than what international standards accounted for.

To reflect GPF’s views and priorities, adjusted GPF-ESG weights and scores were integrated with other data from financial analysis in the fund’s standard asset pricing process.

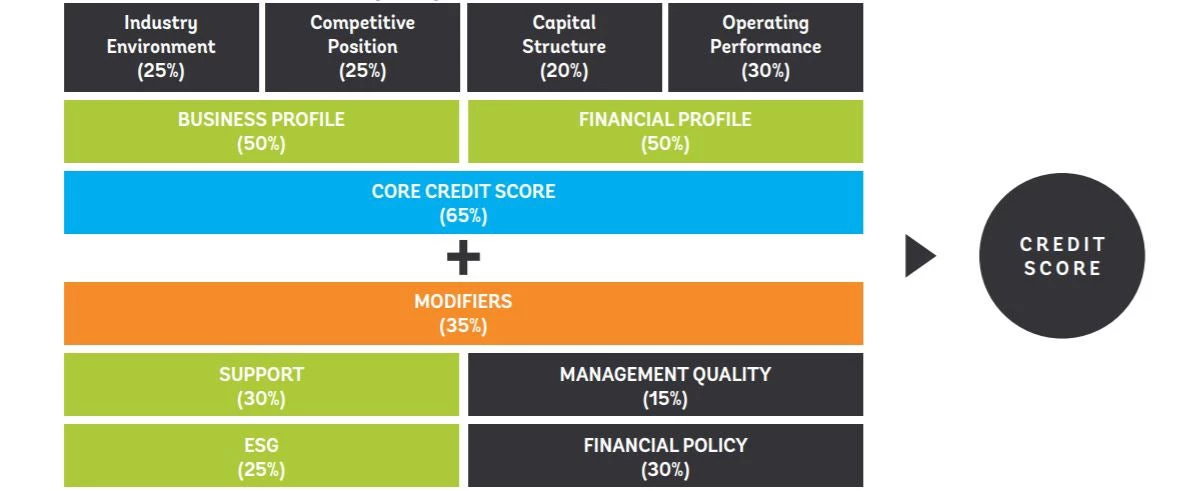

In fixed income investment, GPF now uses the GPF ESG Company Score as an additional material input to calculate the GPF Credit Score for each issuer or company.

Figure 1 +2: MSCI’s Original Sector Weights vs. GPF’s Adjusted Sector Weights

Figure 2: GPF Model of Integrating ESG Factors in Fixed Income Credit Score

Through our work with major global pension funds such as the Government Investment Pension Fund (GIPF) of Japan, the World Bank team has seen the influence that major domestic investors can have on greening their financial systems.

We look forward to working with more champions such as the GPF on adapting international standards in sustainable finance in a way that is appropriate and proportional to the local market context. This is how we will be able to achieve truly global sustainable financial markets and direct capital in a way that contributes to the SDGs. This is how we’ll be able to support these key local investors in a robust, sustainable, and resilient recovery.

Join the Conversation