According to the latest Global Economic Prospects report, global growth will slow from 2.9 percent in 2022 to 1.7 percent in 2023. Photo: Shutterstock

According to the latest Global Economic Prospects report, global growth will slow from 2.9 percent in 2022 to 1.7 percent in 2023. Photo: Shutterstock

Global economic activity is decelerating sharply as a result of synchronized monetary policy tightening to contain very high inflation, less favorable financial conditions, and disruptions from the Russian Federation’s invasion of Ukraine. According to the latest Global Economic Prospects report, global growth will slow from 2.9 percent in 2022 to 1.7 percent in 2023. The outlook has several downside risks, including the possibility of higher inflation, even tighter monetary policy, financial stress, and rising geopolitical tensions . To mitigate the impacts of recent negative shocks and promote a strong and inclusive recovery, policymakers need to prioritize reforms that support long-term growth prospects and bolster the resilience of vulnerable groups.

1. The global economy is perilously close to falling into recession

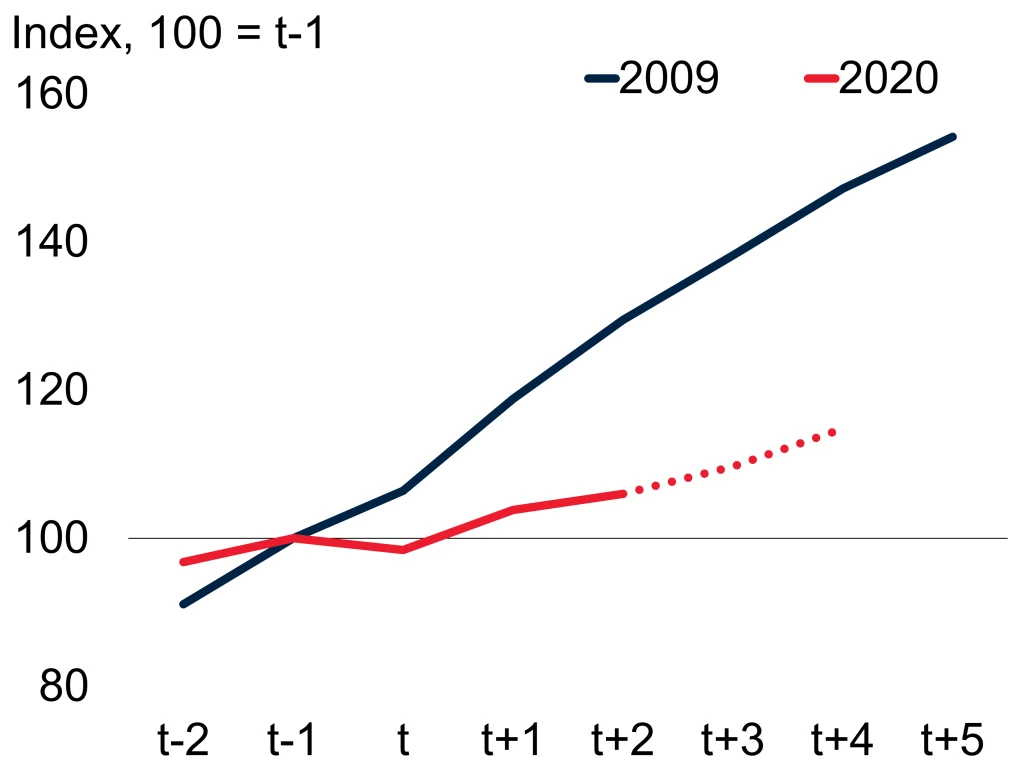

This year, the world economy is set to grow at the third weakest pace in nearly three decades, overshadowed only by the recessions caused by the pandemic and the global financial crisis . Growth has slowed to the extent that the global economy is perilously close to falling into recession—defined as a contraction in annual global per capita income. Major economies are undergoing a period of pronounced weakness, and the resulting spillovers are exacerbating other headwinds faced by emerging market and developing economies (EMDEs).

Global growth

Source: World Bank

Note: Shaded area indicates forecasts. Sample includes up to 37 advanced economies and 144 EMDEs. Aggregate growth rates are calculated using real U.S. dollar GDP weights at average 2010-19 prices and market exchange rates.

2. EMDEs are projected to experience subdued growth in 2023, with activity set to remain well below its pre-pandemic trend

In EMDEs, growth prospects have worsened materially, with the forecast for 2023 downgraded 0.8 percentage point to a subdued 3.4 percent . The downward revision results in large part from weaker external demand and tighter financing conditions. Downgrades to growth projections mean that EMDE activity is now expected to fall even further below its pre-pandemic trend over the forecast horizon. Moreover, per capita income growth is expected to be slowest where poverty is highest.

Deviation of output from pre-pandemic trends

Source: World Bank

Note: EMDEs = emerging market and developing economies. Aggregate growth rates are calculated using real U.S. dollar GDP weights at average 2010-19 prices and market exchange rates. Shaded area indicates forecasts. Figure shows deviation between current forecasts and January 2020 Global Economic Prospects. January 2020 baseline extended into 2023 and 2024 using projected growth for 2022.

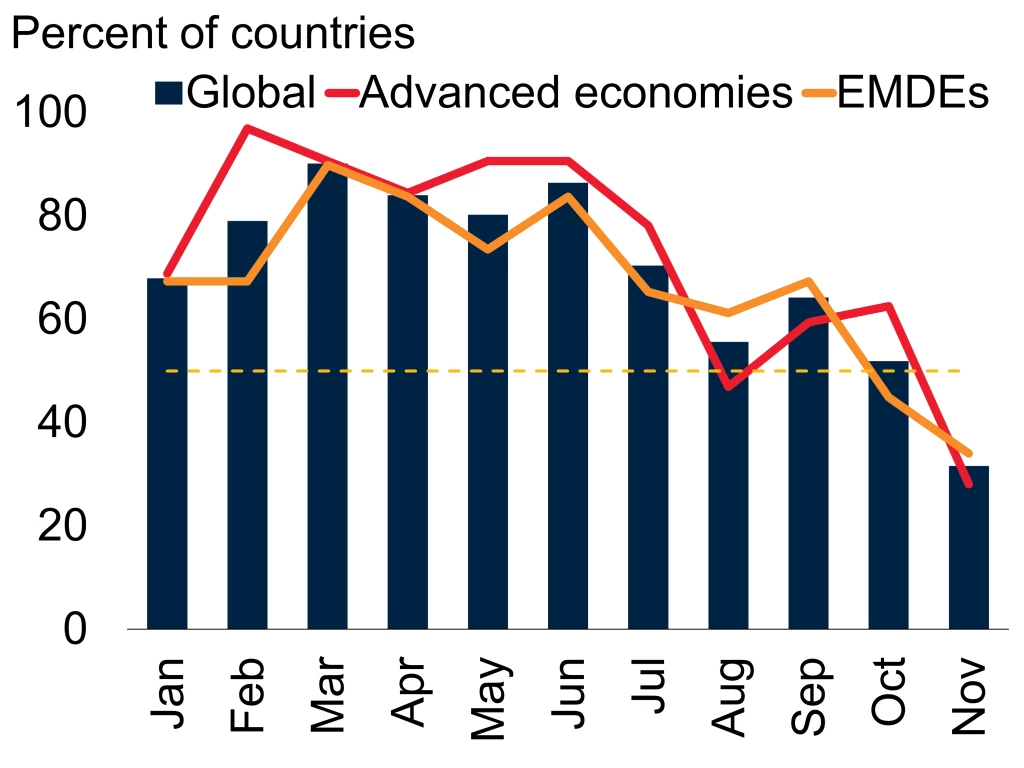

3. Headline inflation has started to abate but high core inflation in many countries has been unexpectedly persistent

Global inflation has been pushed higher by demand pressures, including from earlier policy support, and supply shocks, including disruptions to both global supply chains and the availability of key commodities. Inflationary pressures have begun to abate, reflecting softening demand and easing commodity prices, and inflation is rising in fewer countries. Although inflation is likely to gradually moderate through the year, high core inflation in many countries has been unexpectedly persistent.

Share of economies with rising headline inflation

Sources: Haver Analytics; World Bank.

Note: EMDEs = emerging market and developing economies. Last observation is November 2022. Median inflation for 32 advanced economies and 48 EMDEs.

4. Risks to the global outlook are tilted to the downside

The Global Economic Prospects report features model simulations to assess two downside scenarios for the global economy. In the first scenario, central banks tighten monetary policy more than expected in response to rising inflation expectations, resulting in global GDP growth falling to 1.3 percent in 2023. In the second scenario, major central banks’ policy rates are even more restrictive, and markedly tighter financial conditions lead to significant financing difficulties across EMDEs, leaving the world in recession.

Global growth under different scenarios

Sources: Guenette, Kose, and Sugawara (2022); Oxford Economics; World Bank.

Note: AEs = advanced economies; EMDEs = emerging market and developing economies. These scenarios are produced using the Oxford Economics Global Economic Model. Growth aggregates computed by Oxford Economics using 2015 market exchange rates and prices.

5. Global cooperation and decisive national policies are needed to bolster investment and growth prospects

The overlapping negative shocks of the past three years have weighed on investment—which is set to experience a feeble recovery—and long-term growth prospects in EMDEs. Prioritizing structural reforms to stimulate investment, promote food security, and foster gender equality can help to reverse the impact of these negative shocks and buttress resilience of vulnerable populations . Global cooperation is also needed to mitigate the risk of global recession, debt distress in EMDEs, safeguard the global commodity trading system, and accelerate the clean energy transition.

Investment in EMDEs

Join the Conversation