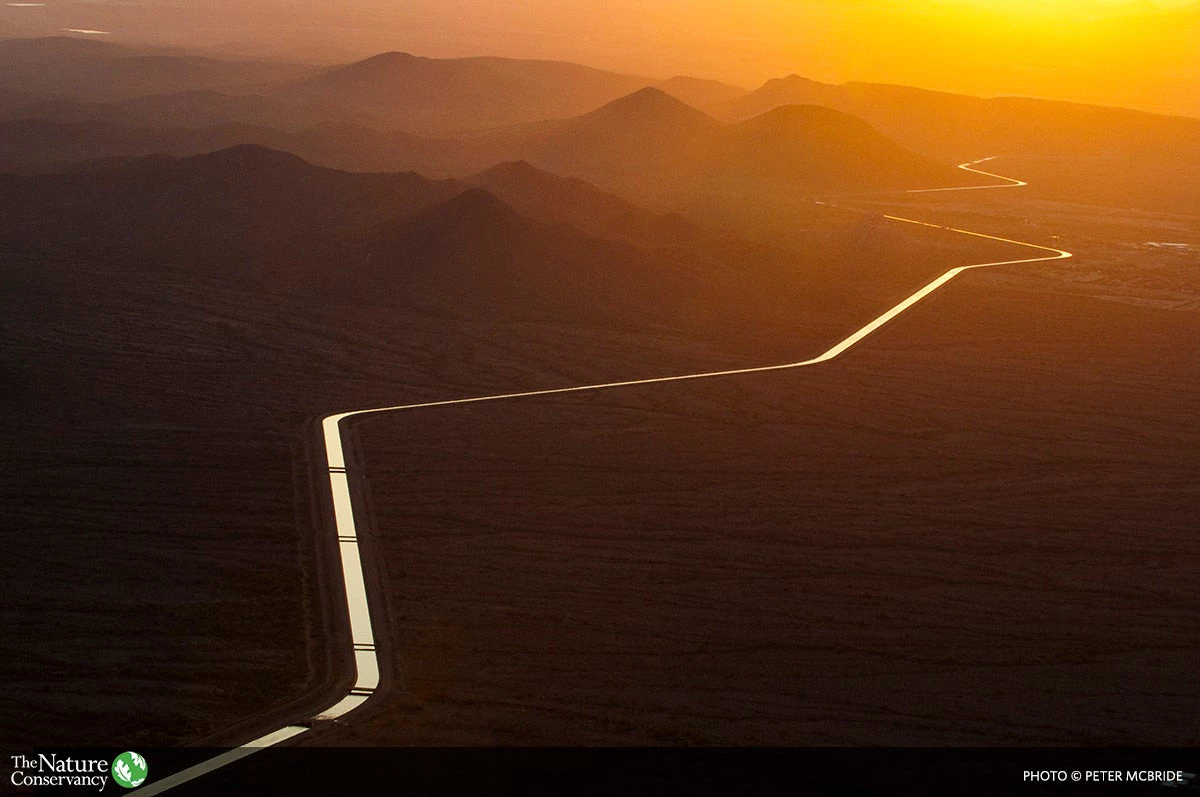

Fresh water touches every part of daily life—from drinking water and sanitation, to agriculture and energy production. Unfortunately, for nearly half of the world’s population, water scarcity is a growing issue with devastating impacts to our communities, economies and nature. In the past, countries have primarily turned to more supply-side infrastructure, including reservoirs and canals, as solutions to increasing water demands. But we can no longer build our way out of scarcity. We must find ways to do more with less, and impact investment can provide a catalyst for revolutionary changes in water management.

Water markets can be a powerful mechanism for alleviating water scarcity, restoring ecosystems and driving sustainable water management. Water markets are based upon water rights which can be bought and sold, enabling water to be transferred from one user to another. A well-managed water market provides economic flexibility, encourages water saving measures and brings a variety of stakeholders to the table to find balance between the water needs of people and nature.

The Nature Conservancy’s new report, “Water Share: Using water markets and impact investment to drive sustainability,” explores the potential for water markets and impact investment to serve as part of the solution to global water scarcity. Water markets, when paired with creative investment solutions including The Nature Conservancy’s concept of Water Sharing Investment Partnerships, can help provide a more water-secure future for cities, agriculture, industries and nature.

In 2015, The Nature Conservancy’s Water program, Australia chapter and impact investment unit, NatureVest, launched the first Water Sharing Investment Partnership in Australia, one of the driest inhabited places on Earth. The Murray-Darling Basin Balanced Water Fund works to improve water reliability for farmers while returning water back to parched wetlands. The mechanism now serves as a model for other water scarce regions.

Today, at least 37 countries in water-scarce regions have established water allocation systems, many of which could benefit from impact investment-driven solutions. If all regions with defined water rights functioned in a similar manner to the Australian market, the markets could collectively generate total annual water sales of US$13.4 billion per year, equating to market assets of US$331 billion. Innovative financing solutions to water scarcity can take many forms to fit local economies, habitats and needs.

As water scarcity intensifies around the world, so must our solutions. Water markets, coupled with creative financial solutions, give us the ability to better sustain our limited water supplies, which ultimately protects both people and nature.

Related link:

Report: Water Share: Using water markets and impact investment to drive sustainability

Join the Conversation