End extreme poverty? Let’s start with financial access for all

What if you had no secure, affordable way to save money, pay bills, or obtain a business loan?

When I was a doctor working with Partners In Health in Haiti and Peru, I didn’t think a lot about this question. We were more concerned with helping people receive treatment for diseases such as multidrug-resistant tuberculosis and HIV. And although we also helped patients access education, training, and get good jobs – many actually started to work with us – we never really discussed how access to financial services could serve as a bridge out of poverty.

I’m now convinced that we should have paid more attention to this critical front in the battle against poverty.

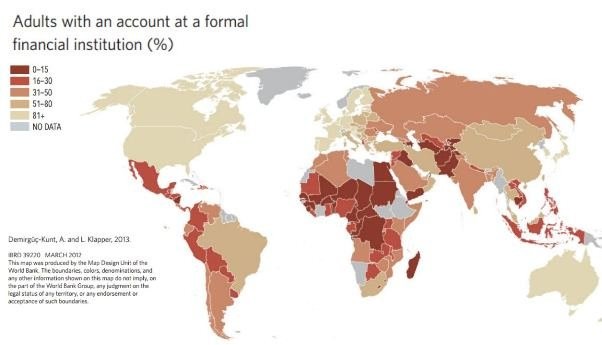

When I came to the World Bank Group, our experts told me that an estimated 2.5 billion people didn’t have access to these kinds of financial services, including 80 percent of those living on less than $2 per day and close to 200 million small businesses. Those are astounding numbers, which speak to lost opportunities on a scale that is massive.

People who are “unbanked” struggle to save, plan for the future, start a business, or recover from unexpected losses. Small businesses without access to affordable financial services or credit can’t acquire capital to invest, grow, and create jobs.

Reducing the financial access deficit requires us to adopt new technologies and work in innovative ways, like building electronic payment systems instead of continuing to use paper money.

Electronic payments lower the cost and increase the security of money transfers, payments, and receipts. In Brazil, the World Bank helped Banco Central do Brasil develop a strategy to make it easier for people with low incomes and those living in rural areas to make payments. In 2013, Brazilians made over 24.7 billion electronic payments – more than China and India combined – and, today, Brazil has approximately 343,000 financial access points, including at least one in each of the country’s municipalities.

Banks and ATMs are often rare in rural parts of developing countries, hindering the financial access of people living in these areas. bKash, a mobile financial company in Bangladesh, has addressed this challenge by turning cell phones into devices that can send and receive money. By the end of 2013, only two years after bKash launched, it counted 11 million registered accounts in a country where 22 percent of the adult population uses mobile financial services. We estimate that bKash was the world’s fastest-growing mobile financial services company in 2013.

Governments can also drive financial access by distributing public benefits electronically. Doing so allows people to obtain social assistance more quickly, and cuts down on opportunities for graft. Electronic transfer systems also reduce the administrative expenses of benefit programs, allowing recipients to keep more of their payments.

Innovative steps will play a key role in unlocking financial access across the developing world. Financial access provides the building blocks people and businesses need to manage their economic well-being, and promotes savings, investment, job-creation, and growth. Financial access also empowers women by making it easier for them to build wealth and create small businesses.

Ensuring that all people have access to financial services will prove essential in meeting the World Bank Group’s goal of ending extreme poverty by 2030. That’s why we’ve partnered with Ajay Banga, the CEO of MasterCard, and the UN Secretary-General’s Special Advocate for Inclusive Finance for Development, Her Majesty Queen Máxima of The Netherlands, among others, to achieve the goal of universal financial access by 2020. The three of us hosted an event with private sector and government leaders at last month’s annual meeting of the World Economic Forum, and will meet again in April at the World Bank Group and IMF’s Spring Meetings in Washington. There, we will announce new steps in our effort to achieve universal financial access by 2020.

More than one in three people on earth now lacks access to basic bank accounts or any kind of credit. Our goal is to bring that number to zero in just five years. Doing so will be an incredible challenge, but the reward will set us on a path to end extreme poverty by 2030.

Waiter at sunset beach hotel

7yT his is a very good step toward poverty eradication in the world especially in Africa my country the Gambia in west Africa would like to benefit from this because we a part of third world countries that need help thank you .

Conseiller scientifique chez Ecole polytechnique fédérale de Lausanne

8ySuggest access to knowledge and know-how is extremely important too:check EPFL MOOCS for Africa program.

ACCA tutor and FM consultant ( ACCA4FP and IFAD/WB) at IFAD/WB/ACCA4F

8yDear Dr Kim, I am a former WB staff. During almost 10 years at the Bank I learnt one important thing: the right people in the right place is the most important for any organization, irrespective of ownership or legal status. I believe that only Steve Jobs and nobody else could create Apple Inc. I also believe that only Jeff Bezos and nobody else could create Amazon and so on. We can say this for all great companies in the world. I also believe that there is only one perfect person in entire universe for any role- starting from security personnel to CEO/President- in any organization. The organization that does its best to get that perfect person for each position will succeed most. In my view, the World Bank's biggest problem is the fact that it has "wrong people" in the middle level manager positions. Unless you address this issue, your efforts will have limited impact on the ground. You need to reform the WB in a way that it will do its best to get that perfect one person in the world for each position.