Global economy recovery after COVID-19 concept. Hands of a researcher in medical gloves takes shot from Coronavirus Vaccine vial by needle syringe with stock index chart rising in the background. © myboys.me/Shutterstock

Global economy recovery after COVID-19 concept. Hands of a researcher in medical gloves takes shot from Coronavirus Vaccine vial by needle syringe with stock index chart rising in the background. © myboys.me/Shutterstock

With the COVID-19 pandemic still looming, global economic activity could unfold any number of ways this year. Depending on the spread or containment of COVID-19, the pace of vaccine dissemination over the next two years, and the level of global financial stress, three alternative outcomes to the baseline forecast in the January 2021 Global Economic Prospects are possible.

Different outcomes, and the factors that influence them, are described in the following charts.

Vaccine rollout

Global growth scenarios depend heavily on the course of the pandemic. In the baseline scenario, vaccination campaigns in advanced economies and major emerging market and developing economies (EMDEs) achieve widespread coverage in the second half of 2021. Vaccination would occur two to four quarters later in other EMDEs and low-income countries (LICs) partly due to logistical impediments. Failures in vaccine deployment could delay this process by more than a year (Figure 1). That said, a faster rollout of vaccines is also a distinct possibility.

The course of the pandemic

Vaccination and pandemic control measures, such as requirement of mask-wearing, can sharply reduce infections. The baseline scenario assumes that a drop in caseloads in the first half of 2021 is made possible by a combination of non-pharmaceutical interventions such as social distancing and vaccination. Delays in vaccine rollout could result in persistently higher caseloads, while an accelerated deployment could meaningfully reduce the pandemic’s spread (Figure 2).

<iframe title="Impact of vaccine assumptions on number of COVID-19 cases in major economies compared to baseline scenario" aria-label="Interactive area chart" id="datawrapper-chart-KKjpG" src="https://datawrapper.dwcdn.net/KKjpG/2/" scrolling="no" frameborder="0" style="width: 0; min-width: 100% !important; border: none;" height="500"></iframe><script type="text/javascript">!function(){"use strict";window.addEventListener("message",(function(a){if(void 0!==a.data["datawrapper-height"])for(var e in a.data["datawrapper-height"]){var t=document.getElementById("datawrapper-chart-"+e)||document.querySelector("iframe[src*='"+e+"']");t&&(t.style.height=a.data["datawrapper-height"][e]+"px")}}))}();

</script>

Averting financial stress

Under the baseline scenario, central banks will continue to be able to avert financial market stress. While prompt resolution of the pandemic may further support global financial conditions, financial stress could mount if the pandemic lingers and economic activity fails to recover. In the direst case, mounting bankruptcies would raise risk premia and borrowing costs and overwhelm bank balance sheets, causing a sharp tightening of global financial conditions (Figure 3).

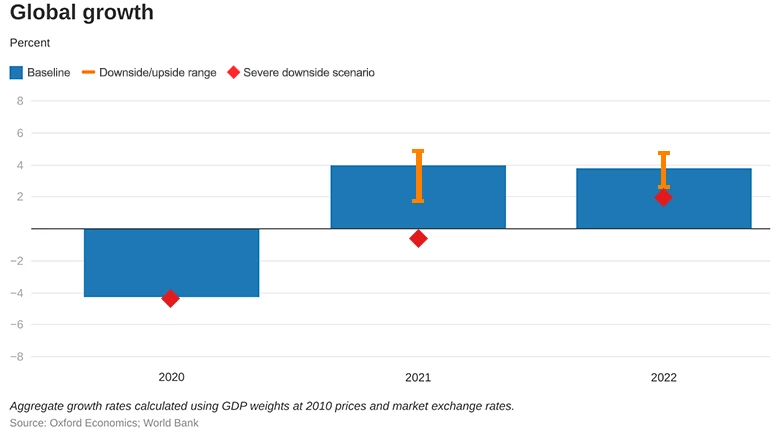

Global growth outcomes

Under the baseline scenario, global economic activity would recover to 4% in 2021 and 3.8% in 2022 (Figure 4). If the pandemic is not contained promptly, in a downside scenario, the global economy could face another year of below-potential growth before a rebound in 2022. And in a severe downside scenario, in which financial crises erupt, the global economy could contract for a second consecutive year—something that has not occurred since the Second World War. Alternatively, in an upside scenario, global growth could average nearly 5% over the next two years if effective pandemic management efforts and prompt widespread vaccination lead to a dramatic decline in COVID-19 transmission.

Emerging market and developing economy growth outcomes

Even in the baseline scenario, while growth in EMDEs would average about 4.5% in 2021 and 2022, output would remain below pre-pandemic trends in 2022 (Figure 5). In a downside scenario growth could weaken to around 3 percent in 2021, and in a severe downside scenario, in which financial crises erupt, EMDEs might face a year of stagnation before a rebound in 2022. In contrast, if the pandemic is brought under control at an earlier date, growth in EMDEs could average nearly 6 percent over the next two years.

Join the Conversation