Unsplash

Unsplash

The war in Ukraine has dealt a major shock to commodity markets. The World Bank’s latest Commodity Markets Outlook discusses how the war has disrupted production and trade of several commodities, particularly those where Russia and Ukraine are key exporters, including energy, fertilizers, and grains. These price increases come on top of already tight commodity markets due to a solid demand recovery from the pandemic, as well as numerous pandemic-related supply constraints.

Figure 1: Commodity price changes

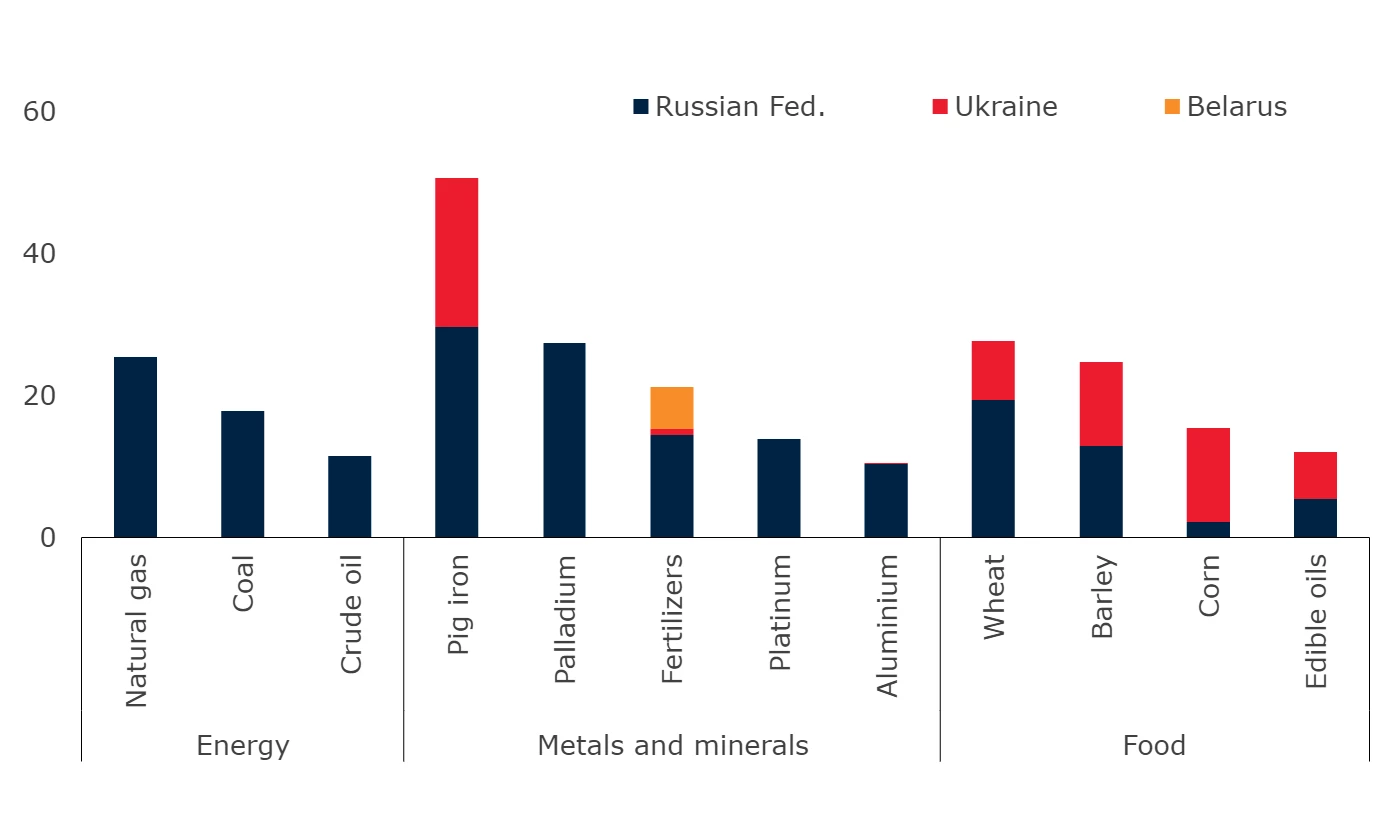

The potential impact of the war in Ukraine on commodity markets happens in two ways: the physical impact of blockades and the destruction of productive capacity; and the impact on trade and production following sanctions. These sanctions are having major global ramifications Russia and Ukraine export many commodities. Russia is the world’s largest exporter of wheat, pig iron, natural gas, and nickel, and it accounts for a significant share of coal, crude oil, and refined aluminum exports. Russia and Belarus are important suppliers of fertilizers. Ukraine is a key exporter of food commodities such as wheat and sunflower seed oil.

Figure 2: Export shares chart

Figure 3: Import shares chart

The war in Ukraine has caused significant disruption to Russia’s energy exports. Several countries have banned or announced a phasing out of imports of some or all of Russia’s energy products, including Canada, the EU, Japan, the United Kingdom, and the United States. Several large oil companies announced they would cease operations in Russia, while many traders chose to boycott Russian oil. As a result, the price of Urals (the Russian oil price benchmark) fell to more than $30/bbl below the Brent oil price following the start of the invasion. In the long-term the departure of oil companies from Russia and reduced access to investment and technology is likely have a permanent negative affect on the country’s energy production.

Figure 4: Urals discount to Brent

The fertilizer market is subjected to supply disruptions. The global fertilizer market was already under severe stress before the war, as nitrogen-based fertilizers are produced from natural gas (or coal in the case of China), and the price of natural gas had soared in 2021, pushing some fertilizer prices to their highest level since 2010. The EU imposed sanctions on Belarus in June 2021, followed by Canada, the United Kingdom, and the United States in August 2021. In early March, Russia’s Industry Ministry announced that it would temporarily suspend fertilizer exports. The announcement followed an earlier ban on ammonium nitrate, to guarantee supplies to domestic farmers. China has also suspended urea and phosphate exports through June 2022 to ensure adequate supplies for domestic food production. Shortages in fertilizers could lead to reduced agricultural yields and production particularly in EMDEs.

Figure 5: Fertilizer affordability

Russia and Ukraine have in recent years accounted for about one-quarter of global exports of wheat. Wheat exports from Ukraine have been halted due to closures of all Ukrainian ports on the Black Sea, accounting for about 90 percent of Ukraine’s wheat exports. This disruption was due to blockades and as such there is less scope for diversion. Limited quantities of wheat exports using rail and road corridors started taking place in early March 2022. But so far, Russian wheat exports have not been affected. Disruptions to wheat exports from Ukraine have already affected several importing countries, especially in the Middle East and North Africa, including Egypt and Lebanon. As a result, several countries have introduced (or announced) trade policy measures that either reduce or ban wheat exports.

Figure 6: Wheat import dependence

Join the Conversation