Workers in a warehouse in Egypt

Workers in a warehouse in Egypt

The outlook for foreign investment is beginning to look a bit brighter after more than a year of severe shock from COVID-19. The pandemic affected output and trade, and caused global foreign direct investment (FDI) flows to fall by more than 40 percent. While global trade rebounded in the second half of 2020, FDI remained weak. But with the global economy expected to grow by 4 percent in 2021, foreign investors may be ready to plan for future expansion—with caution.

Results from the latest World Bank’s quarterly Global Pulse Survey of multinational enterprises (MNEs) in developing countries show a stabilizing investment outlook for MNEs compared with earlier rounds of the survey in 2020. Three-quarters of respondents surveyed in the fourth quarter (October-December) expected to maintain their current level of investment and very few expected to reduce investment. MNEs also reported limited plans for a significant reorganization of investment locations, business models, or supply chain structures.

Still, uncertainty over the course of the economic recovery remains. Foreign direct investment has the potential to support recovery by creating jobs and boosting productivity. To realize this potential, it is critical for countries to have in place the right FDI policies to enhance their competitiveness and give firms the confidence to invest.

Lingering pandemic effects

Despite the gradual improvement overall, the survey showed that the adverse effects of the pandemic were still felt in the fourth quarter of 2020. More than 90 percent of respondents reported being adversely affected in at least one business dimension in both the third and fourth quarters of last year.

MNEs in the manufacturing sector continued to be more negatively affected than those in services, a trend largely driven by weak demand and lingering supply chain disruptions. The sample in the service sector included mainly companies in IT, finance, professional, and logistics services. A higher share of manufacturing firms (71 percent) reported reduced output, compared to 55 percent of service sector firms.

Figure 1: Effects of the pandemic were still being felt in Q4, although the situation is improving

Stabilizing foreign direct investment

After a steep decline in FDI in 2020, investors are still largely waiting on sidelines. FDI data indicate that the pipeline for greenfield investment is limited. The value of new greenfield FDI announcements in developing countries plunged in 2020 and remained more than 50 percent below 2019 levels in the fourth quarter.

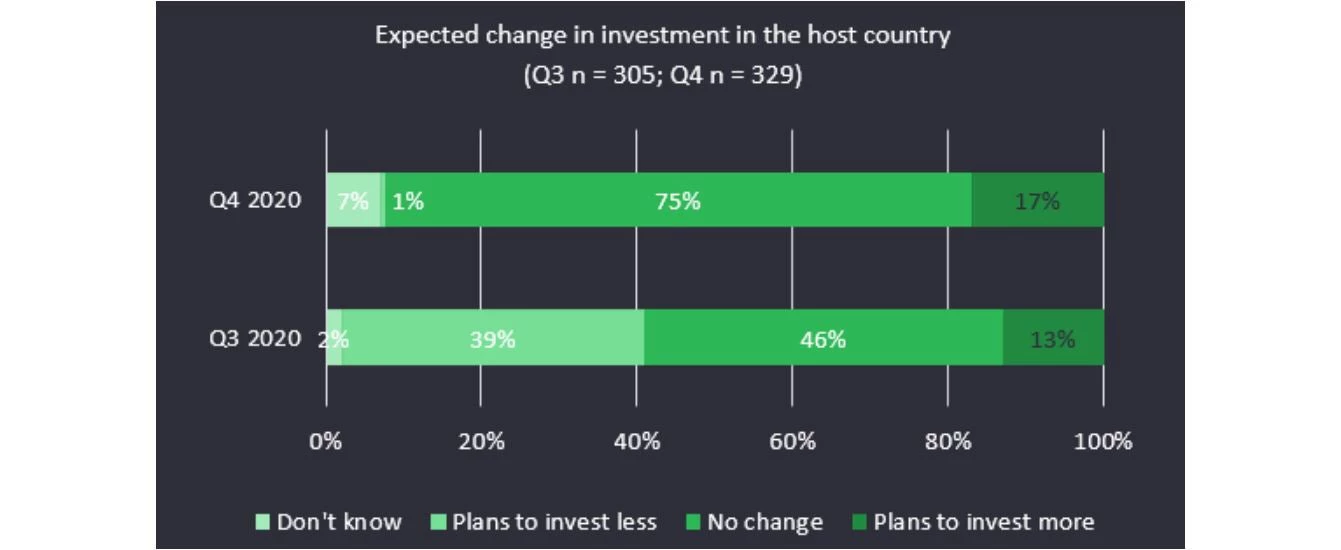

However, survey data suggested that the near-term outlook for foreign investment is stabilizing. In the previous survey round (third quarter of 2020), 39 percent of respondents indicated that their parent company planned to invest less. In the current round this share dropped to about 1 percent, suggesting MNEs’ earlier negative outlook may have been driven by short-term investment plans.

Nonetheless, few MNE affiliates are planning to expand investment in the next one to three years. Three quarters of firms reported that investment levels were expected to remain the same (up from 46 percent in the third quarter), while 17 percent expected investment to increase (up slightly from 13 percent in the third quarter).

Figure 2: Cautious optimism amid uncertainty—the investment outlook in the next 1-3 years is stabilizing

Policies, Growth, and Costs Remain Key to Competitiveness

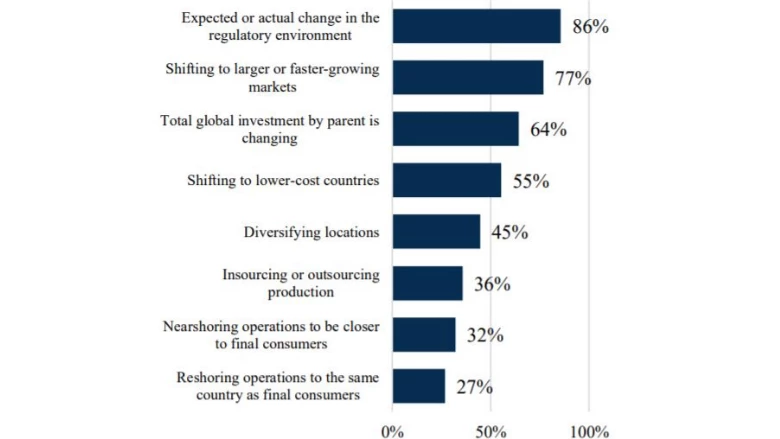

Survey data confirm what literature has consistently shown about the importance of FDI policies in shaping the attractiveness of countries as investment destinations. Among MNE affiliates that expect their parents to invest more in the host economy in the coming years, nine out of ten identify expected or realized changes in the investment policy environment as a driver of their expansion plans.

Figure 3: New investments are driven by FDI regulations, growth markets, and low cost (n = 56)

With prospects of global recovery expected to be uneven, multinational companies are also significantly driven by shifts toward countries that offer larger markets or faster-growth opportunities. Four in five businesses cited this motivation. As always, cost competitiveness of host economies remains a major driver of investment plans. Three in five cited this motivation. To a lesser degree, some investment decisions could be driven by diversifying production locations and adjustments in global value chains aimed at nearshoring or reshoring.

The near-term outlook for foreign investment may be stabilizing, but it will remain highly competitive. Countries should use the crisis as an opportunity to reform trade and investment policies, boost investor confidence, so they can attract foreign investment capital needed to underpin recovery.

This blog is the fourth in a series focused on the results of global MNE pulse surveys during the COVID-19 pandemic. Read about the results of the surveys for the first quarter, second quarter, third quarter, and fourth quarter of 2020.

Explore data on the MNE pulse survey dashboard.

Ryan Kuo and Brody Viney contributed to this blog.

Join the Conversation